MacroFab Blog

Climate change is becoming more widely recognized, and companies are expected to act. Businesses now face growing demands from investors, customers, and regulators to decrease their carbon footprint and be more environmentally responsible.

ESG (Environmental, Social, and Governance) initiatives, once little more than a buzzword, have increasingly become crucial to a business’s success and longevity.

But the electronics manufacturing industry is one of the largest energy and resource consumers globally, responsible for two percent of global greenhouse gas emissions. The production of semiconductors, in particular, contributes significantly to the industry’s carbon footprint due to its reliance on fossil fuels and water-intensive processes.

Checkpoint

Companies with strong ESG performance reduce costs by 5 to 10 percent.

So, how can electronics manufacturers address these issues while maintaining their competitive advantage and profitability?

The solution is to adopt ESG (Environmental, Social, and Governance) initiatives that benefit both their businesses and stakeholders. In this article, we will explore five critical ways in which ESG elements can benefit the PCBA (printed circuit board assembly) industry and the benefits, challenges, and importance of implementing ESG initiatives.

Key Takeaways

• The electronics manufacturing industry is one of the largest energy and resource consumers globally, responsible for 2% of global greenhouse gas emissions. Semiconductor production contributes significantly to the industry’s carbon footprint.

• Implementing eco-friendly manufacturing practices such as recycling electronic waste and using renewable energy solutions can significantly reduce the industry’s carbon footprint while contributing to a sustainable future.

• Businesses with a clear sense of purpose tend to perform better and have better stakeholder buy-in.

• Investing in ESG initiatives is key to long-term success and sustainability for the electronics manufacturing industry.

Understanding ESG Elements in the Electronics Manufacturing Industry

To better understand how ESG investment can create value, it is crucial to introduce the three ESG elements: environmental, social, and governance, and how they impact business practices and their stakeholders.

Environmental Criteria

The environmental criteria in ESG initiatives refer to factors related to the company’s impact on the environment. This includes the company’s carbon footprint, greenhouse gas emissions, waste generation, energy consumption, water usage, and overall ecological impact. The goal of environmental criteria is to ensure that companies operate in a manner that minimizes their negative impact on the environment while contributing to a sustainable future.

The electronics manufacturing industry consumes significant energy and resources, which contributes to environmental degradation. Implementing eco-friendly manufacturing practices that focus on the impact on the natural world can significantly reduce the industry’s carbon footprint.

As an example, recycling electronic waste and using renewable energy solutions such as solar, wind, or geothermal can reduce waste generation and conserve resources.

Social Criteria

The social criteria in ESG initiatives refer to the factors related to a company’s impact on society. The social element examines how a business treats its employees, customers, suppliers, and communities, ensuring provisions for safe and healthy working conditions. It must also adhere to labor laws, prevent discrimination and harassment, and provide fair wages and benefits to its employees.

Additionally, electronic products must be designed with end-of-life management in mind to ensure they do not harm the environment or pose a risk to society. Corporate social responsibility builds trust, enhances reputation, and strengthens relationships with stakeholders.

Governance

Last but not least, governance criteria refer to the factors related to a company’s management and decision-making processes. The governance criteria are essential to ensure that a company operates in a responsible and sustainable manner while creating long-term value for its stakeholders by emphasizing transparency and accountability in business operations.

This includes identifying and mitigating ESG risks, such as regulatory compliance and operational disruption, as well as preventing corruption or bribery in operations and supply chains. The effectiveness of the company’s governance ensures its long-term value for shareholders. By addressing governance criteria, a company can build credibility, enhance transparency, and improve its financial performance.

It is well-known that addressing ESG concerns can provide significant value for businesses and stakeholders. This is evidenced by the fact that companies that prioritize ESG initiatives tend to have higher equity returns, lower downside risk, higher credit ratings, and better valuation. For instance, Siemens is a company that has set ambitious targets for reducing carbon emissions, increasing energy efficiency, and supporting social causes. In 2021, the company’s revenue increased by sixteen percent from the previous year, reaching over $74 billion.

Five Ways ESG Initiatives Create Value

ESG initiatives are crucial for the electronics manufacturing industry as they create value by attracting new customers, reducing costs, limiting risks, and increasing employee productivity. Here are five key ways that ESG initiatives benefit the electronics manufacturing industry:

Driving Revenue Growth

Adopting ESG initiatives can open up new revenue streams for the electronics manufacturing industry. For instance, the growing demand for eco-friendly products presents an opportunity for companies to develop sustainable products that meet consumer needs.

In addition to the benefits outlined, companies within the electronics industry that implement ESG initiatives can also tap into a growing market of environmentally-conscious consumers. These consumers are increasingly prioritizing the environmental impact of the products they purchase, and are more likely to support companies with strong environmental policies.

By adopting sustainable practices and demonstrating a commitment to environmental responsibility, electronics companies can attract these customers and expand their customer base, while also contributing to a more sustainable future.

According to Harvard Business Review research, strong ESG performance can increase a company’s market share by six percent. In addition, Forbes found that 88 percent of consumers prefer to buy products from companies that support social or environmental causes.

Reducing Costs

ESG initiatives can also help companies in the PCBA industry reduce costs. For instance, implementing energy-efficient practices can reduce energy consumption, leading to lower operational costs. Further, recycling electronic waste can help reduce waste disposal costs while also conserving natural resources.

In 2021, McKinsey reported that companies with strong ESG performance reduced costs by 5 to 10 percent. Cost reductions were due to several factors, including increased efficiency, reduced waste, and improved risk management.

Increasing Employee Productivity

ESG initiatives can also positively impact employee productivity. Employees who work for companies that value ESG principles are more engaged and motivated. In addition, companies prioritizing ESG initiatives often have better employee retention rates and lower employer absenteeism. This can significantly reduce costs related to training and onboarding.

Companies benefit from ESG initiatives and strong labor relations. According to Glassdoor, 77 percent of job seekers consider a company’s culture before accepting an offer. Harvard Business Review also found that companies with strong labor relations have a 20 percent higher productivity.

Optimizing Investment and Capital Expenditures

Investors increasingly focus on companies prioritizing ESG initiatives. By implementing ESG initiatives, the PCBA industry can attract more investors and optimize its investment and capital expenditure strategies. Companies may invest in renewable energy solutions to reduce their dependence on fossil fuels and reduce energy costs, or in sustainable products and technologies to ensure their long-term success.

ESG performance is associated with a 5.4 percent return on equity, according to McKinsey, while CDP reports a 67 percent higher return on investment for companies that manage water sustainably. Further, S&P Global found that companies with higher ESG scores had lower debt costs. Examples include energy-efficient equipment, renewable energy, and waste management.

Minimizing Legal and Regulatory Impacts

The electronics manufacturing industry is subject to several regulations and laws that aim to protect the environment and society. However, companies that implement ESG initiatives can proactively mitigate regulatory and legal interventions. For example, companies that comply with environmental regulations are less likely to face legal and financial penalties.

However, companies that adopt sustainable practices often avoid potential legal and regulatory risks entirely, while at the same time minimizing reputational risks that can impact their bottom line.

Challenges of Implementing ESG Initiatives

While implementing ESG initiatives has several benefits for the electronics manufacturing industry, they are not without challenges. Here are three key challenges that the PCBA industry might face when implementing ESG initiatives.

No Unified Regulations

While the electronics manufacturing industry must adhere to several regulations and laws, there are still no comprehensive regulations that require companies to implement ESG initiatives. While some countries and regions have introduced rules, the standards can vary widely across jurisdictions, creating confusion for companies operating across borders.

For example, in the United States, no federal mandate requires companies to disclose their ESG practices, although many states have enacted their own legislation. This lack of framework makes it difficult for investors and stakeholders to assess a company’s ESG strategy.

Thus, companies may hesitate to invest in sustainable practices, especially in regions with minimal regulatory requirements, seeing them as an unnecessary financial burden.

Implementation Costs

Implementing ESG initiatives can also be costly, particularly for small and medium-sized businesses. An average company spends $30 million implementing sustainability initiatives, according to a Deloitte report. This can be a barrier for some that can’t afford the upfront costs of investing in ESG initiatives.

Implementing energy-efficient practices may require companies to invest in new equipment, which can be expensive. In addition, fair labor practices can increase labor costs, affecting the company’s profitability.

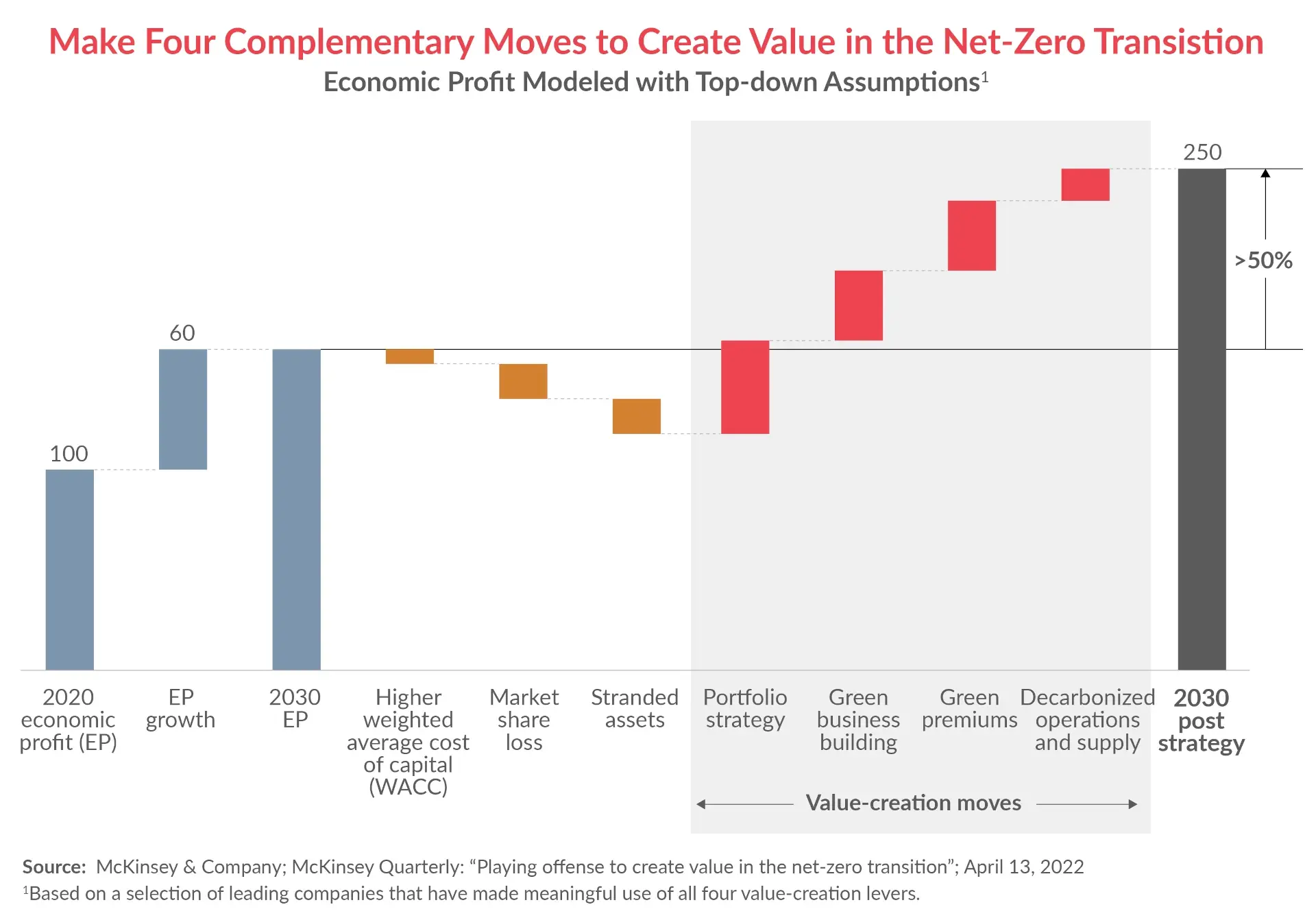

However, it is essential to recognize that the benefits of ESG initiatives often outweigh the costs. Moreover, ESG offers a variety of options for planning under uncertainty, as well as unlocking value and reducing bottlenecks during net-zero decarbonization, as demonstrated in a 2022 McKinsey report.

Changing Cultural Attitudes

Implementing ESG initiatives may require a cultural change within the company. For instance, employees may need to change their behavior to support eco-friendly practices, which may take time and effort. According to a survey by BCG, 70 percent of executives believe that the biggest challenge in implementing ESG initiatives is changing their corporate culture. Companies may also need to completely rethink their business models to incorporate sustainable practices, which may take time and prove challenging.

The benefits of creating a sustainable culture are significant. According to a study by PwC, companies with a clear sense of purpose are 2.5 times more likely to be considered top performers. Additionally, PCBA companies can gain support from all stakeholders by integrating environmental, social, and governance initiatives into their business practices as part of a culture of sustainability.

Conclusion

ESG factors are critical for the electronics manufacturing industry’s long-term growth and sustainability. Adhering to environmental, social, and governance criteria can help the industry reduce costs, minimize legal and regulatory interventions, improve employee productivity, and optimize investment and capital expenditures.

However, implementing ESG initiatives can pose several challenges, such as a lack of comprehensive regulations, implementation costs, and the need for cultural change. Nonetheless, the benefits of implementing ESG initiatives far outweigh the costs and challenges, and it is crucial for the electronics manufacturing industry to adopt sustainable practices to ensure long-term success and profitability.

If the electronics manufacturing industry is to be successful and sustainable over the long haul, it must prioritize ESG initiatives. By adhering to environmental, social, and governance criteria, the industry can create long-term value for its internal and external stakeholders and ensure that its operations are sustainable and responsible.

Related Topics

Reshoring Reduces Electronics Manufacturing Waste

Each type of waste can inflate business expenses and make a negative impact on your company’s environmental, social, and governance (ESG) reputation.

Want to know more about ESG initiatives?

Read “Navigating Sustainability Challenges in Electronics Manufacturing.”

About MacroFab

MacroFab offers comprehensive manufacturing solutions, from your smallest prototyping orders to your largest production needs. Our factory network locations are strategically located across North America, ensuring that we have the flexibility to provide capacity when and where you need it most.

Experience the future of EMS manufacturing with our state-of-the-art technology platform and cutting-edge digital supply chain solutions. At MacroFab, we ensure that your electronics are produced faster, more efficiently, and with fewer logistic problems than ever before.

Take advantage of AI-enabled sourcing opportunities and employ expert teams who are connected through a user-friendly technology platform. Discover how streamlined electronics manufacturing can benefit your business by contacting us today.