MacroFab Blog

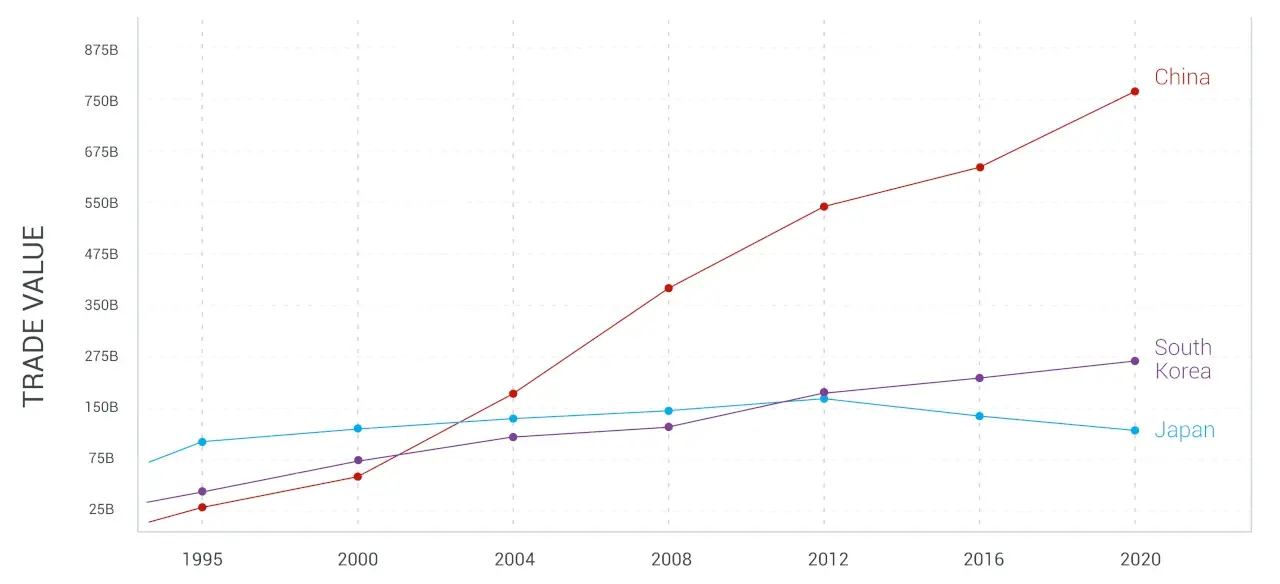

For decades, electronic manufacturing in the Asia Pacific region (APAC) has been a significant driver of global trade. Many of the world’s most popular consumer electronics products, such as smartphones and laptops, are produced in countries in north Asia.

However, exports from mainland China, Japan, and South Korea have softened in recent years. In 2020, for example, global electronics exports from these three countries showed no growth -even as demand for electronics soared.

One primary factor has been the increasing impact of the trade war between the United States and China. As a result of U.S. tariffs, Chinese imports of U.S. goods, including electronics, have flattened out at the beginning of the 2020s. More recently, the South China Morning Post reported that trade restrictions and pandemic-related disruptions in supply chains decreased IC (integrated chip) imports from China to the US by 15.3 percent between 2021 and 2022.

Additionally, trade restrictions imposed by the U.S. on technologies in China have made electronic trade from countries highly linked to China’s supply chains - such as Japan and South Korea - more costly. This shift in trade has had far-reaching repercussions for the electronics industry.

Growing Price Tags in Asia

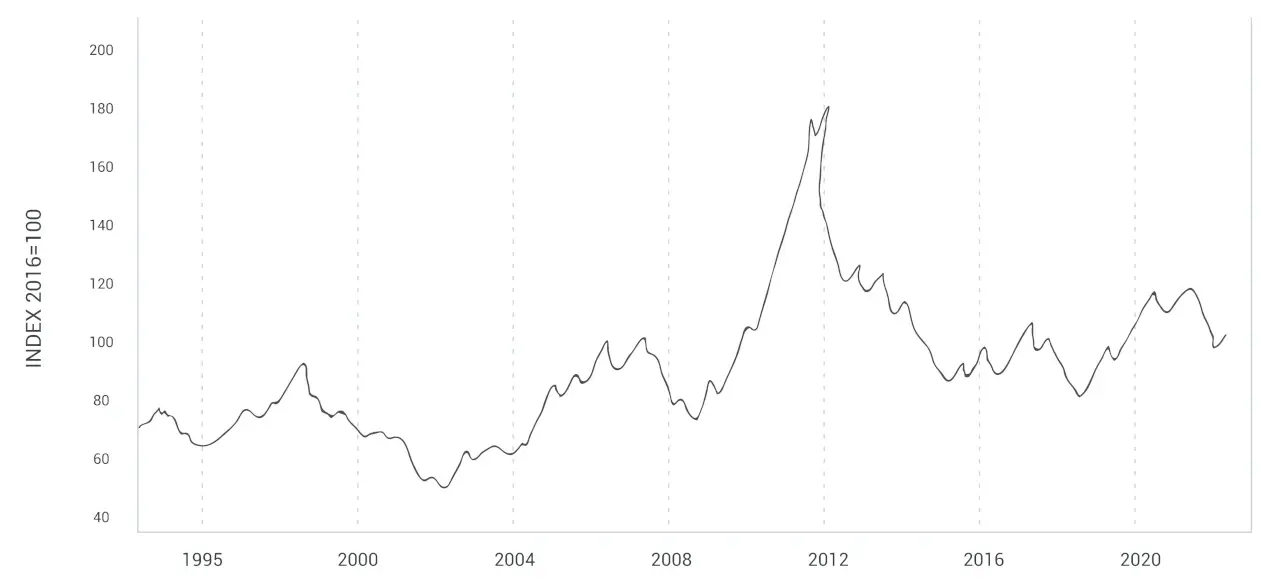

In addition to the effects of the trade war, inflation has raised the costs of raw materials, labor, and other production inputs. In China, for example, the consumer price index (CPI) rose to a six-year high of 2.5 percent in October 2020, driven by rising food prices. In the case of raw materials, the increase has been exceptionally sharp, as metal and component prices have surged due to a combination of rising demand and supply chain disruptions.

Data from South Korea, Taiwan, and other countries in the region shows a similar trend. For example, in South Korea, the consumer price index (CPI) rose to a three-year high of 1.3 percent in October 2020, while in Taiwan, the CPI hit a nine-year high of 2.3 percent in the same month. These inflationary trends have significantly impacted the electronics industry in the APAC region, with manufacturers struggling to keep up with rising costs and new demand driven by technological change.

Tech Solutions Fueling Demand

In addition to inflationary trends, technological developments have also impacted the demand for electronics in the APAC region. For example, the rollout of 5G networks has increased demand for smartphones and other consumer electronics products, while the increasing use of Industry 4.0 has also boosted demand for IoT devices.

For example, in Japan, the number of Internet of Things (IoT) devices in use is expected to exceed 70 million by 2021, while in South Korea, the number of 5G subscribers is expected to reach 20 million by the end of 2021.

Current inflationary pressures have offset the growing demand for electronics in the short term. Recent consumer spending has fallen significantly as individuals react to the tighter economy.

Despite this, the long-term potential for electronic products remains strong, as the shift to online services and increased utilization of technology is expected to drive further demand for consumer electronics products in the years ahead.

However, the impressive growth of new technologies has also highlighted their strategic importance, including national security concerns about relying on only a few suppliers.

Government Intervention Redefining Supply Chains

Foreign governments have also been making strategic moves to reduce their reliance on Asia for electronics production. In the U.S., for example, the federal government has provided billions of dollars in funding to domestic companies to invest in advanced manufacturing technologies and create jobs. Similarly, in Europe, the European Commission has launched a “Made in Europe” initiative to promote the region’s manufacturing capabilities.

The strategic actions by governments have significantly impacted the electronics industry in Asia, and manufacturers in the area have found it increasingly difficult to compete with their foreign counterparts.

The weakening of exports from China, Japan, and South Korea is expected to have far-reaching implications for the electronics industry. Manufacturers from the region will likely face increasing costs and lower product demand in the short term. Chinese manufacturers are now scrambling to diversify their holdings and improve technologies in order to reduce costs and increase productivity.

In the long run, companies that currently manufacture in the APAC region may need to rethink their strategies to remain competitive in the global market. This could mean moving production to another location, possibly back to North America.

A Closer Look Short-Term Economics

The weakened growth momentum in the APAC region is likely to continue, as inflationary trends and foreign governments’ strategic moves make it increasingly difficult for manufacturers in the region to remain competitive.

Production backlogs in APAC manufacturing facilities have been cleared in recent months, resulting in a moderated output. In spite of this, standing orders may boost the region’s economy for several months to come.

According to a recent report from the International Monetary Fund (IMF), global inflation is expected to remain above two percent for the next few years, which could further increase the cost of production for manufacturers in the region. Also, trade tensions to reduce U.S. and Europe’s reliance on Asia for electronics production could continue to harm the region’s exports.

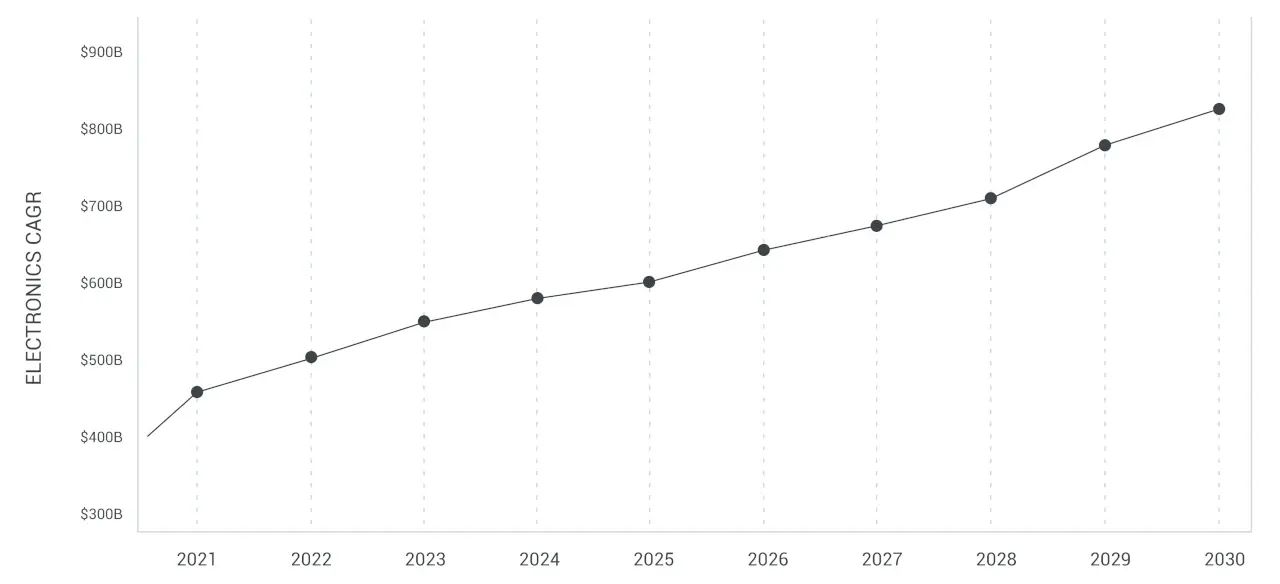

However, despite these challenges, the overall demand for electronics will likely grow. A report from Spherical Insights shows that the global electronics market has an expected CAGR of six percent from 2022 to 2030, owing to the growth of 5G networks and the use of Industry 4.0 devices. As a result, APAC manufacturers are expected to experience growth, but the North American region is expected to grow faster.

Exploring Long-Term Possibilities

While Asia is expected to remain an essential player in the global market, manufacturers must rethink their strategies to stay competitive in the U.S. and European markets. This could include investing in new technologies and outsourcing production to other regions.

Nevertheless, although Asia’s electronics industry has been weakened in recent years, the long-term outlook is far from bleak. The rising demand for consumer electronics worldwide, driven by 5G networks and the increasing use of Industry 4.0 devices, provides a glimmer of hope for the region’s electronics manufacturers. As such, Asia will likely remain an essential player in the global electronics market.

Want to learn more? Read Welcome Home: The APAC to America PCBA Reshoring Guide now.

Checkpoint

Learn more about moving your electronics manufacturing back to North America.

Drawing Conclusions

Manufacturers in Asia have invested heavily in advanced technologies to stay competitive. These investments and technological developments will likely ensure that the region remains a significant hub for electronics production and exports.

In recent years, however, the weakening of exports from China, Japan, and South Korea has been a cautionary tale. Driven by inflationary trends and trade tensions, regional manufacturers have found it increasingly difficult to remain competitive in the global market.

Companies that currently manufacture in the APAC region may need to rethink their strategies to remain competitive in the global market.

Related Topics

Mapping Out a PCBA Supply Chain Strategy in Five Moves

Companies should create unique vendor relationships with numerous international suppliers due to the necessity of having to source components globally.

MacroFab’s Modern Approach to Strategic Sourcing

Many Contract Manufacturers (CMs) and Original Equipment Manufacturers (OEMs) have some sort of procurement team. So what makes MacroFab so different?

Electronics Production: Upgrading Inventory Systems with Modern Tech

Inventory and supply chain management software and processes play a pivotal role in safety, efficiency, & security of electronics manufacturing operations.

Build from anywhere, anytime, with MacroFab.

Get StartedAbout MacroFab

MacroFab offers comprehensive manufacturing solutions, from your smallest prototyping orders to your largest production needs. Our factory network locations are strategically located across North America, ensuring that we have the flexibility to provide capacity when and where you need it most.

Experience the future of EMS manufacturing with our state-of-the-art technology platform and cutting-edge digital supply chain solutions. At MacroFab, we ensure that your electronics are produced faster, more efficiently, and with fewer logistic problems than ever before.

Take advantage of AI-enabled sourcing opportunities and employ expert teams who are connected through a user-friendly technology platform. Discover how streamlined electronics manufacturing can benefit your business by contacting us today.