Trade War Impact on PCBA Supply Chains: Regional Alternatives

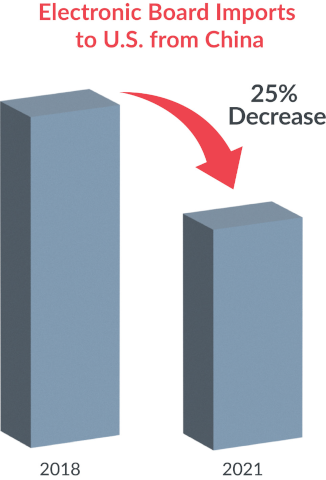

U.S. tariffs on China, imposed during the previous administration and continued by the current one, have worked as designed: U.S. imports of products made in China have decreased, particularly those with tariffs up to 25 percent.

Trade wars and ongoing COVID-related issues continue to lead North American electronics manufacturers to look for regional alternatives for PCB assembly. Although China and the US have long been trading partners on the global stage, ongoing trade tensions and questions over unfair trade practices and intellectual property protection coupled with delays caused by rolling shutdowns and workforce limitations have many companies considering other options.

Recent trade data shows that total U.S. imports from China have fallen by nearly $32.9 billion ( six percent) between the beginning of the trade war in 2018 and 2021. Furthermore, the decoupling of the two economies has been even more drastic in the electronics industry, with U.S. imports falling by ten percent in the same period.

Since then, the U.S. has imposed more restrictions on China’s tech companies.

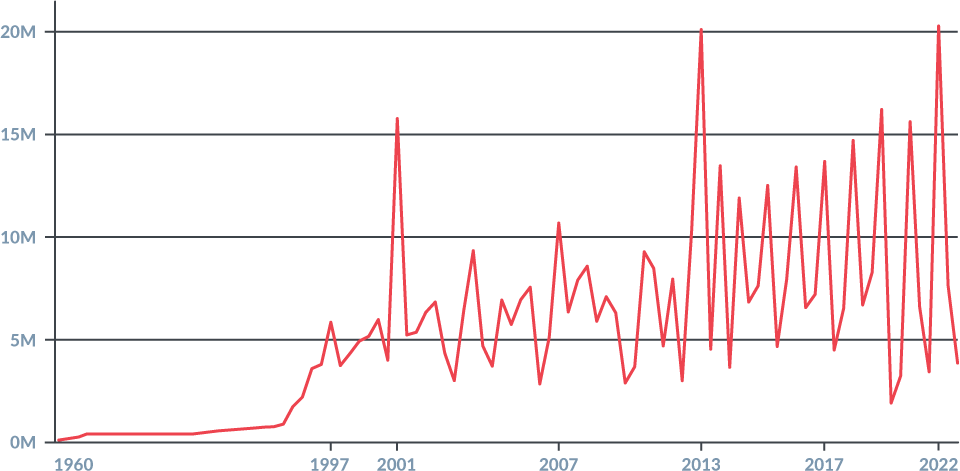

The US-China decoupling is also evident in foreign direct investment (FDI) flow. A previous report by the Rhodium Group found that FDI from China to the U.S. fell from a peak of $46 billion in 2016 to just $7.2 billion in 2020. Meanwhile, FDI from the U.S. to China fell from $14 billion to just $8.6 billion in the same period.

The trade war is causing the U.S. to seek suppliers in other countries, such as Vietnam and Mexico. For example, the U.S. has increased its electronics imports by $32 billion from these two countries since the beginning of the trade war. In addition, U.S. companies have been looking to diversify their supply chains and have moved some manufacturing operations out of Asia.

Foreign Direct Investment (FDI) FlowSee https://www.us-china-investment.org/fdi-data for more details.

One area with steep declines in imports from China is electrical boards, a key component in electronics production. According to trade data, U.S. imports of electrical boards from China have decreased by nearly 25 percent from 2018 to 2021. Moreover, the trend has continued in the months since.

The trade war has significantly impacted the electronics industry. In the United States, companies that rely on imports from China have had to find alternative sources or move to manufacture nearby.

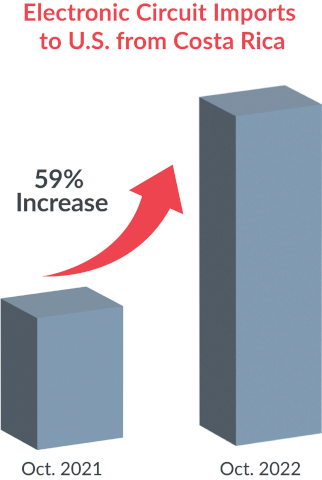

The trade war has presented an opportunity for countries like Mexico and Costa Rica, which have been able to leverage their export-oriented stable economies and favorable business environment to attract technology manufacturers and become global players in the industry.

In recent years, for example, Costa Rica has made a concerted effort to attract investment in integrated circuits, particularly in producing processors and controllers. In addition, the government has implemented policies and initiatives to support the sector’s development, including tax incentives and investment in infrastructure and education. These efforts have paid off, as exports of chips, particularly processors and controllers, have been increasing.

In October 2022, imports to the U.S. of parts of electronic circuits from Costa Rica increased by 59 percent compared to the year before.

One of the critical advantages that countries like Mexico and Costa Rica have to electronic manufacturers is their highly skilled and educated workforce. These countries have a robust education system and a tradition of investing in science, technology, engineering, and math (STEM) fields, resulting in a pool of highly qualified and trained professionals. This has made them an attractive location for companies setting up regional operations.

In addition to their skilled workforce, these countries offer a stable and business-friendly environment, with a pro-trade and pro-investment government committed to attracting foreign investment. Mexico, for instance, has a long history of attracting foreign investment, particularly in the manufacturing and export sectors, and has a well-established export-oriented economy.

In the third quarter of 2022, Mexico captured a record of $32.15 billion (29.5%) in FDI. Close to half of the investments went to manufacturing.

Checkpoint

Trade wars and ongoing COVID-related issues continue to lead North American electronics manufacturers to look for regional alternatives for PCB assembly.

As companies look to diversify their supply chains and reduce their reliance on Asia, they have turned to other regional countries as alternative manufacturing hubs. This has helped to drive demand for regional exports.

Overall, the trade war has significantly impacted the global electronics industry, resulting in the emergence of new regional manufacturing hubs.

The trade war has demonstrated how heavily the U.S. and global economies rely on Asia as a supplier of goods and services. As a result, regional alternatives may be attractive for companies looking to reduce their dependence on Asian supply chains and mitigate risks.

Read about 2024 Trade Regulations affecting electronics and PCBA tariffs now.

Countries like Mexico and Costa Rica are proving their attractiveness to foreign companies with a well-educated and stable workforce and a pro-trade government. As the trade war continues and companies look for alternatives to APAC-region suppliers, these countries are well-positioned to capitalize on the shift.

Related Topics

Preparing for Potential Supply Chain Disruptions During Lunar New Year

This blog discusses on how to prepare for unexpected events for global supply chains such as the dockworker strike in preparation for Lunar New Year.

Mapping Out a PCBA Supply Chain Strategy in Five Moves

Companies should create unique vendor relationships with numerous international suppliers due to the necessity of having to source components globally.

Struggling with Inflexible PCB Assembly? MacroFab's Got Your Back.

Many electronics designers struggle with systems that demand complete data and specific formats upfront. Wouldn't it be great if there was a better way?

Let’s Work Together

Request a QuoteAbout MacroFab

MacroFab offers comprehensive manufacturing solutions, from your smallest prototyping orders to your largest production needs. Our factory network locations are strategically located across North America, ensuring that we have the flexibility to provide capacity when and where you need it most.

Experience the future of EMS manufacturing with our state-of-the-art technology platform and cutting-edge digital supply chain solutions. At MacroFab, we ensure that your electronics are produced faster, more efficiently, and with fewer logistic problems than ever before.

Take advantage of AI-enabled sourcing opportunities and employ expert teams who are connected through a user-friendly technology platform. Discover how streamlined electronics manufacturing can benefit your business by contacting us today.